Key Points

-

NEC4 ECC and PSC Option C and E contracts allow the project or service manager to check the contractor’s or consultant’s records that ultimately support defined cost payments.

-

The cost of staff working on the contract should be included in the defined cost for people and set out in the schedule of cost components.

-

This article provides guidance on what to look for when auditing people cocosts on NEC4 Option C and E contracts, particularly if the contract has been amended.

The NEC4 Engineering and Construction Contract (ECC) Option C (target contract with activity schedule) and E (cost reimbursable contract) are widely used for procuring high-risk infrastructure projects in the UK, often alongside the simpler NEC4 Professional Service Contract (PSC) for design and other professional services.

Clauses 50.9 and 52.4 in Option C and E contracts allow the project or service manager – usually delegated to a cost manager – to inspect accounts and records of the defined-cost items claimed, which includes the cost of staff working on the project. These form part of ‘people’ costs detailed in the schedule of cost components. Actual cost is at the heart of these inspections, so the assurance work needs to focus on payroll departments and associated payslips, employment contracts, payroll reports and timesheets.

This article sets outs a simple roadmap for effective auditing of people costs on NEC4 Option C and E contracts.

Read contract

The first step is to review the contract carefully for staff variations, in particular in the detailed scope information and any additional Z clauses. Next, check the reimbursement method. Frequently defined cost paid against the schedule of cost components gets substituted for pre-agreed rates. This is often done for simplicity or data protection, but it can lead to problems on long-term contracts if inflation, role churn, overtime, promotions and so on are not properly considered.

Also, even though NEC4 PSC Options C and E now expect staff to be paid against the schedule of cost components, some clients amend them to the former NEC3 PSC approach of time charging at a pre-agreed rate. If there have been contract amendments, start by comparing the staff ‘rules’ within the schedule of cost components against an unamended version. It is important to understand the tweaks, which are common in pensions, bonuses, sick pay and expenses, and the reasons why. Also, look to see if the wider rules specify certain roles that cannot be charged and are therefore deemed to be an overhead, and so part of the fee. Key to this will be understanding definitions in and around the working areas.

Next, check for any specific mobilisation rules in the scope. These can be many and varied but look out for pre-commencement rules which must be complied with. For example, check if résumés need to be shared in advance with the client, approved and what happens if not. Check too what rules are given if a new role is being mobilised and how the rate gets considered and calculated. Also see if there are rules on handover periods that try to limit exposure on churn and duplicate costs.

When the work or service starts and staff start being charged, the following questions should be considered.

-

How detailed are the rules in the contract around time charging?

-

Must a timesheet specify certain information or format?

-

How detailed is the activity narrative required?

-

Who (client and supplier side) has to approve the hours, and is it within a time limit?

-

Are there specific rules regarding preauthorisation of overtime?

-

Which roles or grades might overtime apply to?

-

Or does the contract give minimal rules? If so, what potential problems might that bring with it, for example a supplier which does not ask its staff to do timesheets, they just do central allocations.

Also, auditors must be mindful themselves of the rules under which they have been engaged, such as whether it is just basic support for the project or service manager in ongoing monthly application-for-payment assessments, or a more generic audit, or to assist in a final assessment calculation.

Understand environment

An understanding of the environment in which staff costs are prepared, controlled and reported in the project is critically important to the assurance work as this influences risk. Less control equals more risk, which in turn equals more inspection.

Start by obtaining a good background on the project and the contractor or consultant. Consider process reviews to understand preventative and detective controls to drive robust charging and application-for-payment compilation. Also gain an understanding of what additional data can be produced outside of the regular data. Assess the maturity and stability of the contractor or consultant operating open-book contracts and the supplier team in managing staff costs. Ideally good financial control should be demonstrated with respect to the day-to-day costs charged to the project.

Auditors also need to understand the physical site or office in which staff work. Things to check are the proximity to the client’s team, integration of the teams, nature of the work, expectation on charging,

ratio of full-time workers to contract staff, and how the account has progressed.

Staff costs typically start early so expect a conversation with the client cost manager on cumulative staff costs, headcount, full-time employees and progress against the programme. Check if the account has been heavily reviewed to date or if costs have been disallowed, and what risks or concerns emerge from these conversations.

It is also likely that the contract explains the cost management environment relating to staff, whether this be requirements for organisation charts, resource plans, monthly budget versus actual analysis, and forecasting reports. Again, understand what these key documents indicate.

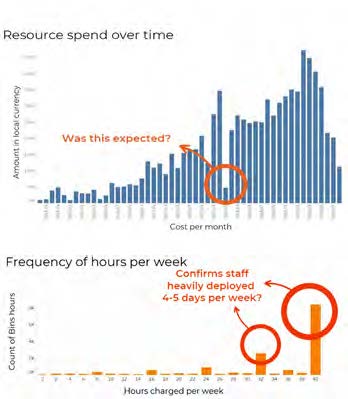

Visualise data

Intelligent data analysis and visualisation are key tools to understand how and where money has been spent (see example tables). People data can be heavily protected by data protection rules, making analysis difficult. When contracts need proving back to actual cost, staff costs are usually anonymised, journaled or separately actualised at routine points in time. This can be complex, but if pre-agreed rates are used, analysis is much easier as time-charge data is that bit simpler to handle.

Intelligent data analysis and visualisation are key tools to understand how and where money has been spent (see example tables). People data can be heavily protected by data protection rules, making analysis difficult. When contracts need proving back to actual cost, staff costs are usually anonymised, journaled or separately actualised at routine points in time. This can be complex, but if pre-agreed rates are used, analysis is much easier as time-charge data is that bit simpler to handle.

The other issue with staff data is that there is often a lot of it, perhaps best described as high volume and low value when viewed at transaction level. However, once the data is sufficiently cleansed, analysis can quickly be undertaken. Ensure it is relevant to the rules of the contract and the project environment to reveal relevant mischarging risks.

Design tests

A thorough understanding of the environment, plus good data analysis should help shape where costs may be mischarged against the identified rules. It is also important to consider or link all the rules back to specific tests. This should identify people or trends of interest for further inspection.

Evaluate records

Beyond test design, a pragmatic sampling strategy is also needed for risk-based and other core transactions to give the assurance coverage required. For pre-agreed rates, test individual people. For actual staff costs, consider looking at auditing by cost component. This keeps sampling simple and manageable. Remember, sampling must be relevant to the wider population, so it is important not to focus on just a few people at a certain grade or those that are a significant cost in one year.

Request the information required from the contractor or consultant and mutually agree a data protection-compliant review process. If things appear wrong, always try to understand why and establish the root cause of the issue, such as a control problem or an isolated error. Check if the contractor’s or consultant’s responses hang together and whether it is necessary to widen the sampling to understand the problem better.

Write report

All examinations should follow a robust and formal recording and reporting process. Make it clear in the report what items have been in scope and what conclusions have been drawn. These should be evidence-based and not poorly thought-through extrapolations. For internal purposes, make sure there is an audit trail of the work completed and assurances obtained so they can be accessed again in future.