Key points

- For an advanced payment to be made in an NEC4 contract, secondary option X14 needs to be used.

- NEC users need to be aware of the potential difference between starting date and contract date as the X14 repayment schedule is based on contract date.

- Where considering use of an advanced payment bond, NEC users should obtain specialist advice to ensure the document is drafted appropriately.

- NEC users should ensure the advanced payment is repaid before completion.

Standard forms of construction contract often include a procedure for advanced payment to the contractor, which is usually made at the initial stage of a project. This may also be referred to as a down payment, mobilisation fee, upfront payment or loan payment. In NEC4 contracts it is achieved through secondary option X14. There are numerous reasons why an advanced payment may be made, including: assisting with cash flow, procuring critical mobilisation resources, ensuring commitment to a project, and assisting an ‘emerging’ supplier.

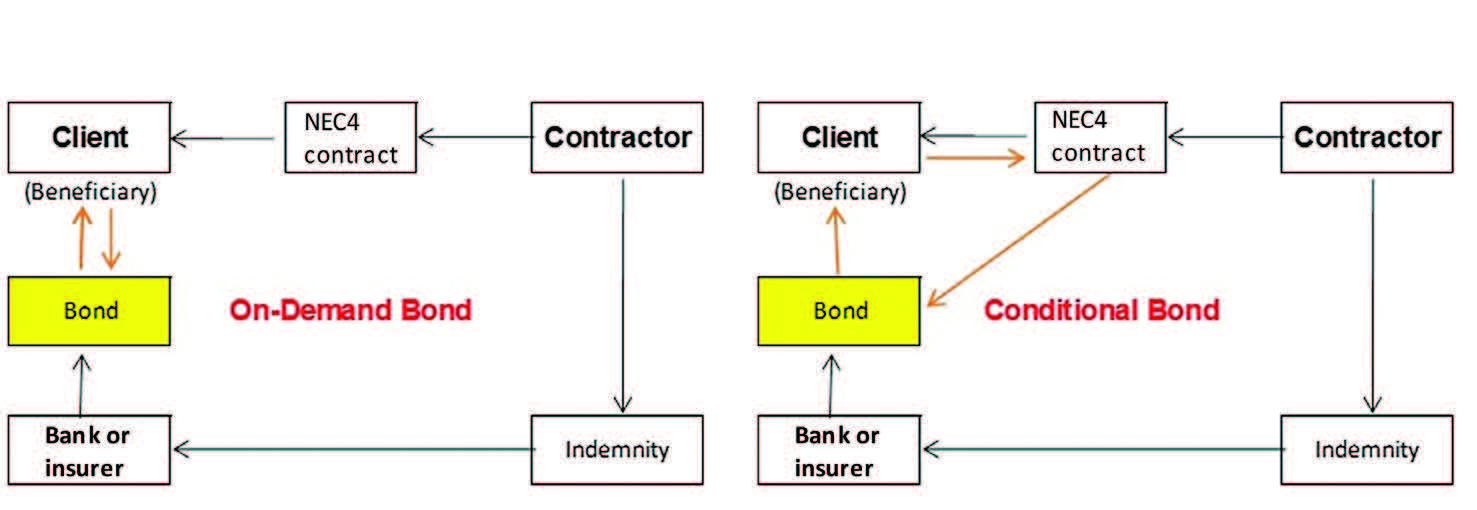

In some cases the client requires an advanced payment bond from the contractor as an indemnity in the event of a contract default. There are three types of advanced payment bond, which is determined by the relationship between the bond provider and the beneficiary, and ascertained by the wording of the bond: on-demand – primary obligation, conditional or default – secondary obligation, and hybrid – primary obligation but with stated conditional requirements. The primary and secondary relationships are shown in Figure 1.

Secondary option X14

Secondary option X14 is in the NEC4 Engineering and Construction Contract (ECC), NEC4 Engineering and Construction Subcontract (ECS), NEC4 Supply Contract (SC) and NEC4 Design, Build and Operate (DBOC). It is split into three parts.

Sub-clause X14.1 provides that the advanced payment amount is stated in the contract data. There are no rules to govern the amount of an advanced payment. As to timing, the advanced payment is made at either the first assessment date, or at the next assessment date following receipt of an advanced payment bond. Note for DBOC, the earliest date after which the advanced payment is included in an assessment is stated in the contract data.

Sub-clause X14.2 applies where an advanced payment bond has to be provided by the contractor to the client, with the requirement stated in contract data. The advanced payment bond is issued by a bank or insurer that has been accepted by the project manager, with the stated reason for non-acceptance being that the commercial position is not strong enough to carry the bond. Any assessment criteria would likely refer to the credit rating of the bond provider. A rating score from a registered credit rating agency is assigned (e.g. AAA, AA, A, BBB, BB, B). For clarity, it may be appropriate to state the required credit rating in the scope.

The advanced payment bond is for the amount the contractor owes, such that it decreases as repayment instalments are made. The bond is in the form set out in the scope, which determines both the terms and type of bond. Any delay by the client in making the advanced payment is a compensation event.

Sub-clause X 14.3 relates to when repayment of the advanced payment is to start and the amount of the instalments, both of which are stated in the contract data. This makes express reference to the contract date, which is likely to be different to the starting date. The contract data defines the repayment instalments as being, ‘either an amount or a percentage of the payment otherwise due’. Note that the ‘payment otherwise due’ may be reduced where secondary option X16 on retention also applies.

Whatever the repayment terms, the parties need to ensure that repayment is achieved before completion. It is advisable to model possible cash-flow scenarios to assess that this will actually occur, especially considering the issue with the potential difference between starting date and contract date.

Issues to consider

The advanced payment bond and type are stated in the scope. As the project manager can give an instruction to change the scope under clause 14.3, NEC users should note this could include changing the type of bond. Another point to check is whether the scope states the required credit rating of the bond provider.

NEC users should ensure the procedure and associated timescales under option X14 are included on a programme submitted for acceptance so that the effects of any delay in making the advance payment can be more readily assessed.

Users should also consider the possibility of the repayments being subject to interest so that the client is compensated for making the advanced payment. This also provides the contractor an incentive to repay as early as possible.

Advance payment bonds can be on-demand (left) or conditional (right), or a combination of the two